A business of any rank needs to deal with tax, a fee charged (levied) by a government on a product, income, or activity. That fee is to be calculated, charged, and received from customers. It is a complex task that requires time and resources of a company. The calculations cannot be completely avoided of course, but the system can be handled quite professionally with Vtiger 7’s Tax Management System.

With this hallmark, you can cope with local and international tax rates and problems pretty efficiently.

Note! Tax Management System is available in only in Sales Professional Edition and Ultimate Edition.

Tax Calculation

All of the complicated computations regarding tax can be systemized in Vtiger 7. When the calculations are configured, those will be accessible to utilize in Quotes, Sales, Orders, Invoices, and Purchase Orders.

Taxes defined in Tax Calculations are global, and not limited to products. Here is how you can set up taxes in Vtiger 7:

- Click on the Menu button on the top left

- Select Settings from the Menu

- In the left side-bar go into Inventorydrop-down

- Then click Tax Management

With the CRM’s Tax Management tool, 3 calculations can be carried out:

- Tax Regions

- Taxes

- Charges (& its taxes)

Tax Regions

Tax laws vary from country to country or even in different states. Tax regions can be thorny to handle as the phenomena include the supervision of dissimilar tax laws at a same time. Tax management tool provide the opportunity to select tax regions while creating Quotes, Invoices, Sales Order and Purchase Order.

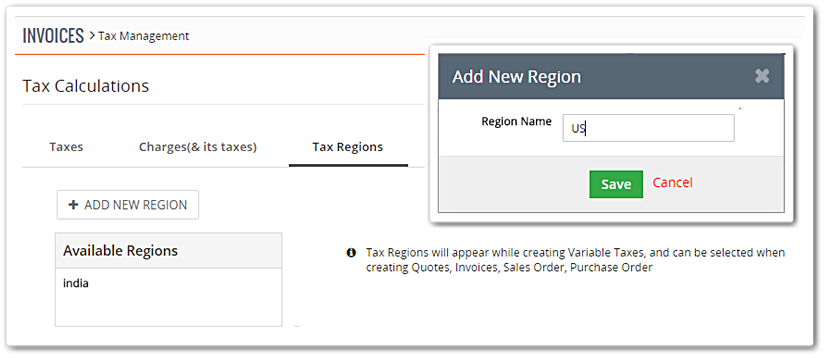

To add new region:

- In the Tax Management, go the Tax Regions tab

- Click on the +Add New Region button

- A popup will appear where you can add a country or a state.

Tax regions can also be deleted in Vtiger 7. However, it will have its consequences upon the inventory taxes with the existing regions.

Taxes

There are 2 modes of Tax in Vtiger 7:

- Group Tax: To fill in the tax rates configured in Tax Calculations for groups, select Group when generating Invoice, Quotes, Purchase order, and Sales Order. This is a smart way to avoid the trouble of applying same taxes on multiple products exclusively.

- Individual Tax: Applying taxes on groups may not be the case every time. The other type of tax available in Vtiger CRM is product specific. That means that it can only be applied to individual products in contrast to group tax. To do so, simply select Individual Tax Mode when producing Invoice, Quote, Sales or Purchase Order.

Configuring All Types of Tax

A new tax can be configured in the Taxes tab. Although, the procedure is lengthy, the potential outcome is worth your time. The functionality works for both national as well as international taxes.

Simultaneously, an existing tax can be modified, enabled or disabled (tax’s status). Disabled tax values will neither show up in Products module nor get counted in Invoices, Quotes, and Sales and Purchase Orders.

-

Tax Types

- 1st is the Fixed tax that is default or fixed value

- 2nd is the Variable tax which is conditional on tax region.

-

Tax Calculations

There are 3 different ways to calculate tax

- Simple

- Compound

- Deducted

- Simple Tax – This is calculated after computing the net total deducting the discount.

- Simple, Fixed – Simple Taxes like VAT, Service Tax, Sales Tax etc. can be fixed i.e. the configured tax value would not vary.

- Simple, Variable – Region based calculations of simple tax are simple variable. Value that is not indicated for a specific region, gets replaced by default values.

2. Compound Tax – It is a tax that is calculated on top of one or more simple taxes.

Eg 1: Let the Product cost be $200 per unit. If the compound tax [composition of 4.5% VAT, 12.5% Service Tax, 2% Sales Tax] of Tax Value 2% is applied on the product, then the cost of the product after tax will be $220.18

Note! A Compound Tax cannot have another compound tax within it.

- Compound, Fixed – This type of compound tax has unchangeable tax value. Learning from the above example, the Tax value 2% is compound fixed.

- Compound, Variable – Tax value for multiple regions is calculated as per the regions’ policies. In the above example, the Tax Value 2% can be altered according the regions.

Consider the Default Tax values for all regions – 5%, USA – 10%, India & Sri Lanka – 7% and N/A for New York. Since there is not any tax value for New York, the default tax value i.e. 5% will be functional for it.

Note! Simple, Compound, and Deducted tax types are not interchangeable. And so does their sub-types.

- Deducted Tax – Deducted Tax is handy in cases where tax is withheld before a payment is made to the vendor.

Just like IRPF tax in Spain is applicable only for self-employed individuals. The value is deducted before payment by the clients.

Eg: The Deducted Tax value is set to 2% in the Tax Calculation Settings. On creating the Invoice, it can be changed to Deducted Tax for 2.5%.

Charges

With Vtiger 7’s tax management system, additional fees like shipping, handling, delivery, or security charges can be overseen without any need of extra staff. Charges are not calculated for non-products or non-services payments. Moreover, those are computed along with the invoices, quotes, and sales orders.

Putting a New Charge in

Adding a new charge will have a particular worth allotted to that charge above all the taxes incorporated within it.

Charge Format

There can be two ways in which a charge is added to the net total:

- Direct Price

- Percent

- Direct Price: This will be added directly to the “Charge” block after being calculated.

Consider an additional fee for a $250 product is $2 (fixed). This fee could be for any purpose like shipping or delivery, which will probably remain same regardless of the product cost.

2. Percent: A percentage of the product cost will be calculated and included to the net total.

In any case, when a percentage of the total amount is to be calculated and included, percentage charge will be handy. Say product cost is $250 and the Charge value added is 2% of the Charge.

Types of Charge

A type of charge can be selected while adding a new charge to Vtiger 7 tax tool.

- Fixed: A single charge value regardless of location

- Variable: Multiple charge values depending upon the regions of the sales.

Charges can be applied for specific regions also. Any region specified within the tax in Tax for Charge field will be applied for a Charge that includes this tax.

Consider that freight tax has a default tax value 2%. But the value is 2.5% for London. When calculating the final price including freight tax, a tax value of 2.5% for London will be included to the net cost as a Charge.

Charge Value

This field in the Add New Charge section defines the default value to be displayed in the item sum of an article. It can be fixed anytime.

Like in shipping and handling charge, if the charge value for specific merchandise is 100, the amount can be reformed to 150 while generating the invoice.

This is a sample image of an invoice item total field, as you can see that there are several options available to modify the invoice.

Adding New Tax for Charge

In the tax management tool of Vtiger 7, new taxes can be added to be used in charges. The added taxes will only be valid for the charge and not on every transaction. The tax will be either simple or compound.

While adding a new tax for charge, enable it to make tax on charges visible. Select Tax field in the above snapshot indicates that it is applicable only for taxes which are selected from the simple charge taxes.

A charge can have any sum of taxes involved within it. Even the tax value in the inventory is changeable. Following is the screenshot of a sample invoice item total field, demonstrating tax values.

Note! The tax defined in the Charge field will only be pertinent for those Charges.

Charge designing has following versatilities:

- One tax can be applied to multiple charges.

- A charge can be made without applying a tax to it i.e. adding a tax to a charge is not mandatory.

- Both simple and compound taxes can be involved in a charge.

It is, however, to be kept in consideration that compound tax will behave as simple tax if the simple tax in compound one is set to be disabled (while creating any Inventory).

For Example, Import Charge has a compound tax say Freight Tax (2%) that has simple taxes – VAT (1.5%) and Sales (1%). If both the simple and compound taxes are disabled while creating any of the inventories, then the Freight Tax (2%) will behave as a simple tax.

Restrictions!

- A charge cannot be contained within another charge.

- A charge doesn’t have deducted tax within it.

Taxes in Products and Services

The default values and the values taking into account the location can likewise be set by record level in the Product and in addition Services module.

To avail this feature of Vtiger 7, go to the Tax Calculation Settings and enable the functionality i.e. changing the tax values in the Product/Services. Additionally, it also gives you the flexibility to reconfigure tax value region vise.

Print Template Enrichment Related To Taxes

In Merge Fields > Record Fields, upgrade the Print templates with Merge Fields that have tax region, deducted tax etc.

The Shipping & Handling Tax merge tag is renamed as “Tax on charges” and Shipping & Handling charges information merge tag is renamed to “Taxes on charges information”.

Selecting the Tax Region from Invoice Line Items

Let’s go through 2 cases relevant to selecting the region while generating or editing a simple inventory record.

Case 1 – For determined Tax Regions:

The values specified for the region (taxes, charge, charge taxes) will be appearing in the calculation block.

- When the calculation follows Individual tax format. In this case, the tax and discounts will be functional for all individual taxes.

- For Group Tax Types, as you can observe in the following pictorial demonstration that neither tax nor discount is applied on individual tax. Instead the Tax Field below is applying the tax for all products depending on the Item Total and Charges fields.

Case 2 – For taxes without region boundaries:

For the taxes, charges, and charge taxes, the default values will be displayed and available at the moment of computation.